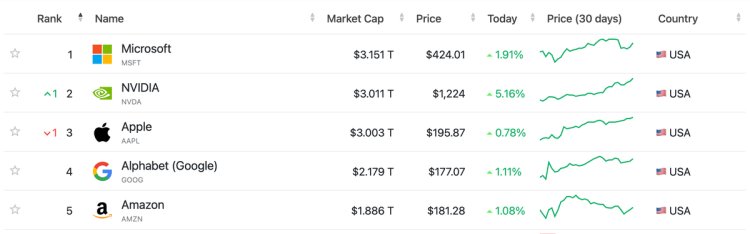

Nvidia Hits the $3T Market Cap Club, Passing Apple, Trailing Only Microsoft

M.G. Siegler, writing at Spyglass yesterday: Today, NVIDIA hit the $3T market cap mark and passed Apple in that same metric. NVIDIA is now the second most valuable company in the world, only behind Microsoft. At this rate, they’ll catch them by Friday, just ahead of their 10-for-1 stock split. The stock run-up has been totally and completely insane. The price is up over 200% in the past year. Over 150% in the past six months alone. Five years ago, NVIDIA’s stock was trading at $36/share. Today it closed at $1,224/share. Is this sustainable? I mean, no. And it’s not because NVIDIA isn’t a great company. This run is just almost meme stock-like in its frenzy, with shades of Tesla, of course. It has just transformed into this sort of index bet on AI. And while AI is also real, it also can’t sustain the current investment hype surrounding it forever. But for now, founder Jensen Huang should enjoy this moment. He should, but one of these companies is not like the others: ’23 Rev

M.G. Siegler, writing at Spyglass yesterday:

Today, NVIDIA hit the $3T market cap mark and passed Apple in that same metric. NVIDIA is now the second most valuable company in the world, only behind Microsoft. At this rate, they’ll catch them by Friday, just ahead of their 10-for-1 stock split.

The stock run-up has been totally and completely insane. The price is up over 200% in the past year. Over 150% in the past six months alone. Five years ago, NVIDIA’s stock was trading at $36/share. Today it closed at $1,224/share.

Is this sustainable? I mean, no. And it’s not because NVIDIA isn’t a great company. This run is just almost meme stock-like in its frenzy, with shades of Tesla, of course. It has just transformed into this sort of index bet on AI. And while AI is also real, it also can’t sustain the current investment hype surrounding it forever.

But for now, founder Jensen Huang should enjoy this moment.

He should, but one of these companies is not like the others:

| ’23 Revenue | ’23 Profit | ’22 Revenue | ’22 Profit | |

|---|---|---|---|---|

| Microsoft | $212 B | $72 B | $198 B | $73 B |

| Apple | $383 B | $97 B | $394 B | $100 B |

| Nvidia | $61 B | $30 B | $27 B | $4 B |

Ming-Chi Kuo on X, claiming some Being Right Points™ for predicting this three months ago:

The prediction from three months ago has come true. This is not just a comparison of Nvidia and Apple’s stock prices but a contrast between the strong growth trend of AI and the innovation challenges faced by consumer electronics.

One man’s “strong growth trend” is another man’s “hype bubble”. And what exactly are the “challenges faced by consumer electronics”? Even with Nvidia’s exhilarating growth in the last two years, Apple generates over 6× Nvidia’s revenue. Apple’s numbers have not been growing, yes, and that’s a legitimate concern for investors. But Apple’s growth stopped not because interest in phones has slowed but because everyone in the world who can afford one has one. That’s a problem, but that’s a good problem.

(Apple and Nvidia both dipped back under $3T today, for what it’s worth.)

What's Your Reaction?

![[Computex] The new be quiet cooling!](https://technetspot.com/uploads/images/202406/image_100x75_6664d1b926e0f.jpg)